|

This is a file from the Wikimedia Commons. Information from its description page there is shown below.

Commons is a freely licensed media file repository. You can help.

|

Description

| Description |

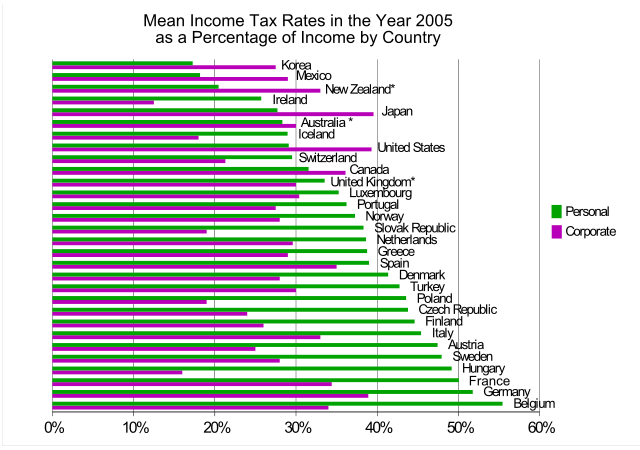

This graph shows average income taxes by country in year 2005. The 'Personal rate' is the average rate of income tax for a worker on the average income in that country.

Note Personal rate is calculated using the combined central and sub-central government income tax plus employee and employer social security contribution taxes, as a percentage of labour costs defined as gross wage earnings plus employer social security contributions. The tax wedge includes cash transfers.

The 'Corporate rate' is the mean combined corporate income tax rate which includes central and sub-central rates.

The 'Corporate rate' chart is noted as follows "Where a progressive (as opposed to flat) rate structure applies, the top marginal rate is shown." It is showing the top rate for corporate taxes, not a mean rate. * For Australia, New Zealand and the UK, all with a non-calendar tax year, the rates shown are those in effect as of 1 July, 1 April and 1 April, respectively. |

| Date |

|

| Source |

Source the OECD http://www.oecd.org/document/60/0,2340,en_2649_34533_1942460_1_1_1_1,00.html table I.2 and table II.1 |

| Author |

en:User:GameKeeper |

| Description |

Ce graphique montre la moyenne des impôts sur le revenu (NDT: et certaines autres charges sociales) par pays, pour l'année 2005. Le 'Personal rate', taux d'imposition des personnes physiques, est le montant moyen des taxes (NDT : et charges) sur le revenu pour un travailleur sur le revenu moyen de ce pays.

Le Personal rate est calculé en additionnant les impôts locaux, les impôts centraux et les contributions de sécurité sociale des employés, le total étant rapporté au coût du travail défini comme l'ensemble des revenus bruts plus les contributions de sécurité sociale des employeurs (revenu "super bruté). Le tax wedge inclut les transferts.

Le 'Corporate rate', taux d'imposition sur les sociétés, est la moyenne combinée des impôts sur les entreprises qui inclut les taux des gouvernements centraux et locaux. Le graphique 'Corporate rate' est noté comme suit : lorsqu'il s'agit d'un impôt progressif (différent de la 'flat tax', impôt à taux unique, c'est le taux marginal qui est indiqué." Concernant les impôts sur les sociétés, est indiqué le taux marginal, pas le taux moyen. |

| Date |

|

| Source |

Source the OECD http://www.oecd.org/document/60/0,2340,en_2649_34533_1942460_1_1_1_1,00.html table I.2 and table II.1 |

| Author |

en:User:GameKeeper |

| Other versions |

http://en.wikipedia.org/wiki/Image:Income_Taxes_By_Country.svg

|

history on en:wikipedia : * (del) (cur) 21:15, 12 February 2007 . . GameKeeper (Talk | contribs) . . 810×570 (66,999 bytes)

Licensing

| Public domainPublic domainfalsefalse |

|

I, the copyright holder of this work, release this work into the public domain. This applies worldwide.

In some countries this may not be legally possible; if so:

I grant anyone the right to use this work for any purpose, without any conditions, unless such conditions are required by law.Public domainPublic domainfalsefalse

|

File usage

The following pages on Schools Wikipedia link to this image (list may be incomplete):

This file contains additional information, probably added from the digital camera or scanner used to create or digitize it. If the file has been modified from its original state, some details may not fully reflect the modified file.

Wikipedia for Schools brings Wikipedia into the classroom. SOS Children is an international children's charity, providing a good home and loving family to thousands of children who have lost their parents. We also work with communities to help vulnerable families stay together and raise children in the best possible environment. Why not try to learn more about child sponsorship?